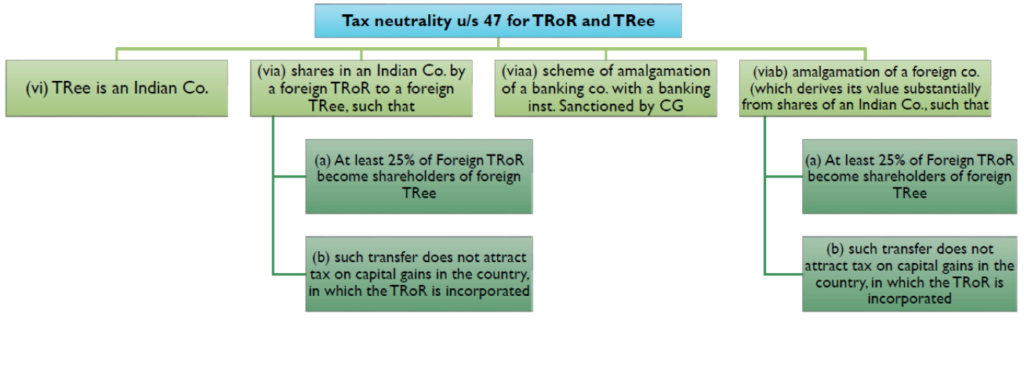

Transfer of any capital asset is subject to capital gains tax in India; However, amalgamation enjoys tax-neutrality with respect to tax on transfer.

Taxability in the hands of shareholder – Sec 47 (vii) – not regarded as transfer

any transfer by a shareholder, in a scheme of amalgamation, of a capital asset being a share or shares held by him in the amalgamating company, if—

Where there has been an amalgamation of—

Industrial undertaking means any undertaking which is engaged in—

Nature of loss

Conditions for Transferor

Conditions for Transferee

Conditions for set-off, under Rule 9C [pursuant to sec 72A (2) (b) (iii)]

Points to note-

For apportionment of depreciation b/w the TRoR and TRee, following steps should be followed [proviso to S.32(5)]

Amortisation of amalgamation expenses [sec. 35DD]

Treatment of Bad-debts [sec. 36 (1) (vii)

Points to note-

Explanation 1- Meaning of “Undertaking”- It includes

Key Considerations

Cherry-picking of Assets & Liabilities

The Hon’ble Delhi High Court vide its judgement in Indo Rama Textile Ltd, In re [2012] 23 taxmann.com 390/[2013] 212 Taxman 462 (Delhi), held that-

“in a demerger, transfer of all common assets and/or liabilities relatable to undertaking being demerged is not required so long as the assets and liabilities transferred, by themselves, constitutes a running business and the business can be carried on uninterruptedly with such assets and liabilities alone”

The Delhi High Court further held that-

To ensure that the undertaking has been transferred as a going concern or not, while sanctioning a scheme of arrangement, the Court can examine whether essential and integral assets like plant, machinery and manpower without which it would not be able to run as an independent unit have been transferred to the resulting company.

Explanation 2- Meaning of Liabilities – it shall include-

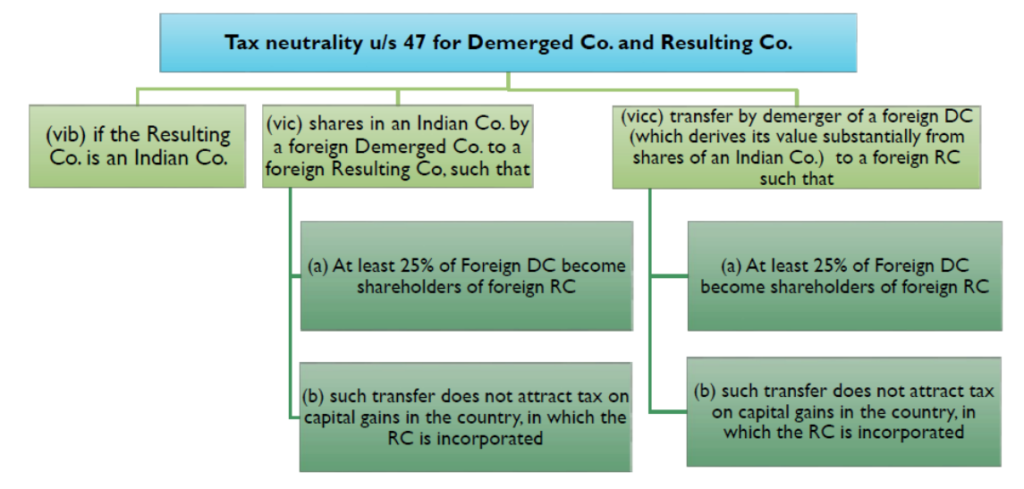

Transfer of any capital asset is subject to capital gains tax in India; However, demerger enjoys tax-neutrality with respect to tax on transfer.

Taxability in the hands of shareholder – Sec 47 (vid)

Cost of acquisition will be computed as under

By virtue of Section 49(2D) the COA of shares in the Demerged Company shall be:

For apportionment of depreciation b/w the Demerged Co. and Resulting Co., following steps should be followed [proviso to S. 32(5)]

Amortisation of demerger expenses [sec. 35DD]

Treatment of Bad-debts [sec. 36 (1) (vii)

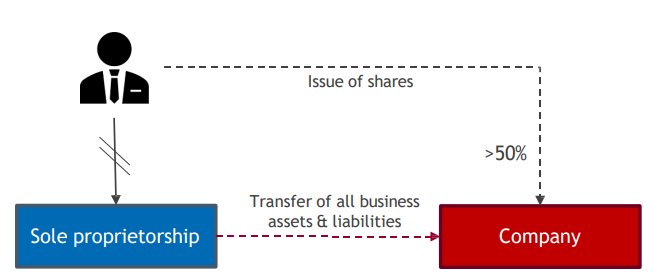

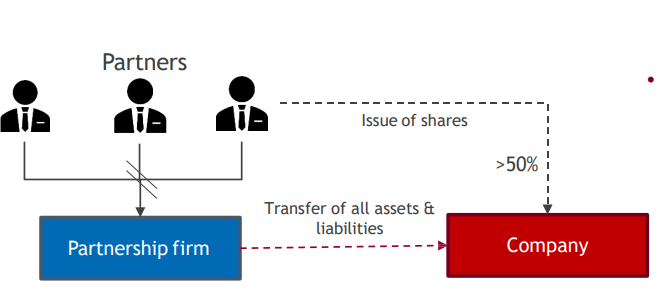

Tax neutral subject to conditions:

Other Aspects:

Prescribed process under Companies Act

Tax neutral subject to conditions:

Other Aspects:

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content: